Reuters/Brendan McDermid

- Wall Street's fear gauge soared the most since February on Monday as stocks fell more than 2%.

- The decline in stocks comes as concerns grow about the spread of the COVID-19 Delta variant.

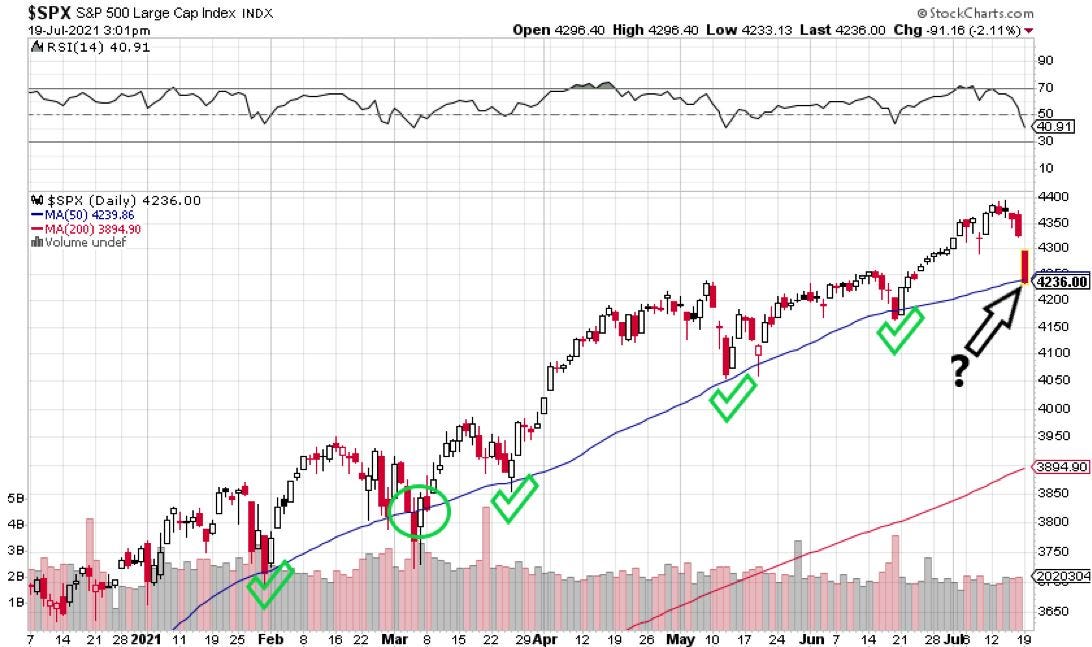

- Monday's decline brought the S&P 500 to its key technical 50-day moving average support level.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A 2% decline in the stock market on Monday sent Wall Street's fear gauge soaring the most since February as investors grow concerned about the spread of COVID-19's Delta variant.

The Volatility Index, also known as the VIX, soared as much as 34% on Monday to above the key 20 level, which is often monitored by CTA and Quant funds as to when to add or remove leverage from their portfolio and in-turn buy or sell stocks. Monday's move in the VIX failed to outpace the fear gauge's 46% surge on February 25.

The move higher in volatility comes as the S&P 500 tests a crucial technical support level that could determine the future direction of stock prices. The stock market's 50-day moving average stood at 4,239, just below the S&P 500's price of 4,242 at time of publication.

Moving averages are a lagging trend-following indicator that technical analysts use to smooth out price movements and help identify the direction of the current trend in place.

Traders view the the 50-day moving average, which is the average daily closing price of a stock over its previous 50 trading sessions, as a short-term moving average that often represents areas of support or resistance for a security.

If the stock market notches decisive and consecutive daily closes below the 50-day moving average, investors will likely look to the 200-day moving average as the next key support level. The 200-day moving average for the S&P 500 currently sits at 3,894, representing potential downside of 8% from current levels.

Conversely, if the S&P 500 is able to decisively close above its 50-day moving average, that would tee the market up to retest its record highs made last week at 4,393, suggesting potential upside of 4% from current levels.

Year-to-date, the S&P 500's 50-day moving average has successfully acted as support five separate times amid market sell-offs.

Technical analyst Katie Stockton views the current sell-off as a "healthy pullback" that could represent a solid buying opportunity for investors.

"I would be looking for opportunities to add exposure (and, cover shorts) in the coming days assuming the signal gives way to stabilization," Stockton told Insider on Monday.

Meanwhile, Fundstrat's Tom Lee thinks stable bond yield spreads suggests that the stock market won't stage a deeper sell-off, and that the rising fears of COVID-19's Delta variant set risk assets up well for a rally in the second half of 2021.

"We don't expect this period of chop to lead to a larger 10%-like decline for markets. Sure, a 3%-5% sell-off, even to S&P 500 4,100 is possible," Lee said.

The S&P 500 is currently down about 4% from its record highs reached last week, and is up about 13% year-to-date.